The attendee can learn and understand the background of the law, what must be considered and who must be included when contemplating or implementing a change in payroll frequency. The best practices, practical points as well as legal requirements discussed will assist in making the transition as smooth as possible for your employees and your department. There are numerous other considerations that should be discussed when implementing a payroll frequency change.Īttend this 90 minute presentation to better understand the requirements under Federal and State Laws when contemplating or implementing a change in payroll frequency. Petty Cash Checkmark this option if this vendor or employee will be using.

#Checkmark payroll changing frequencies manual

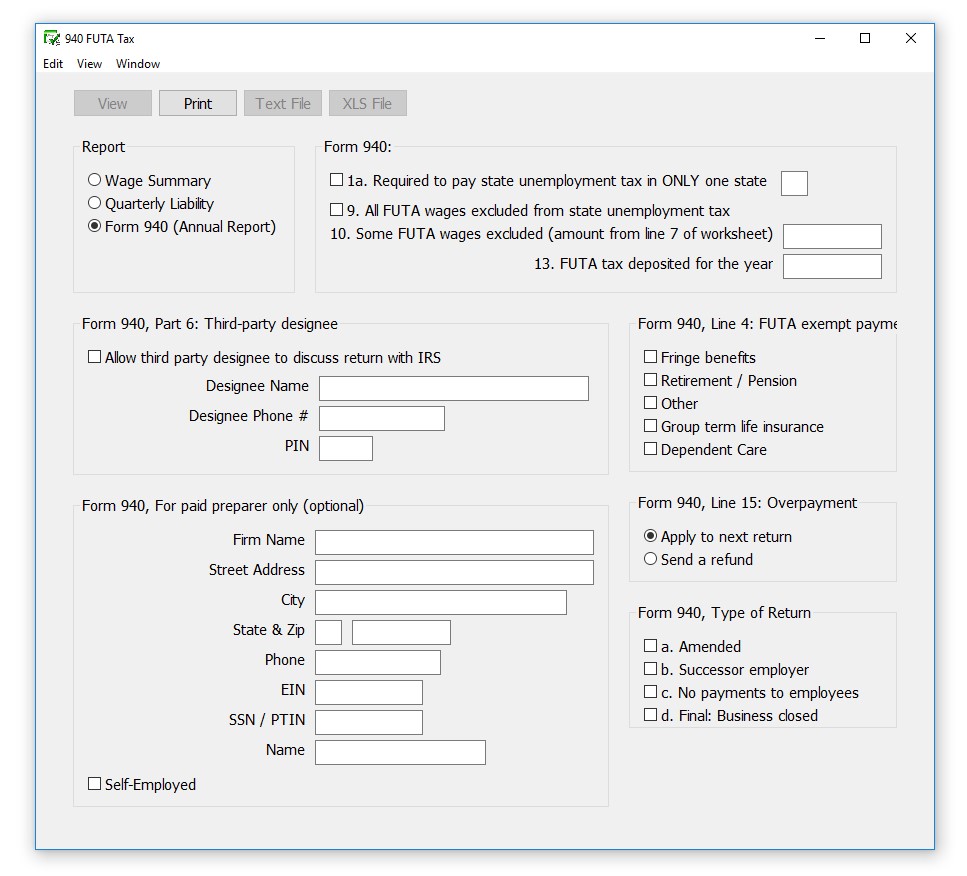

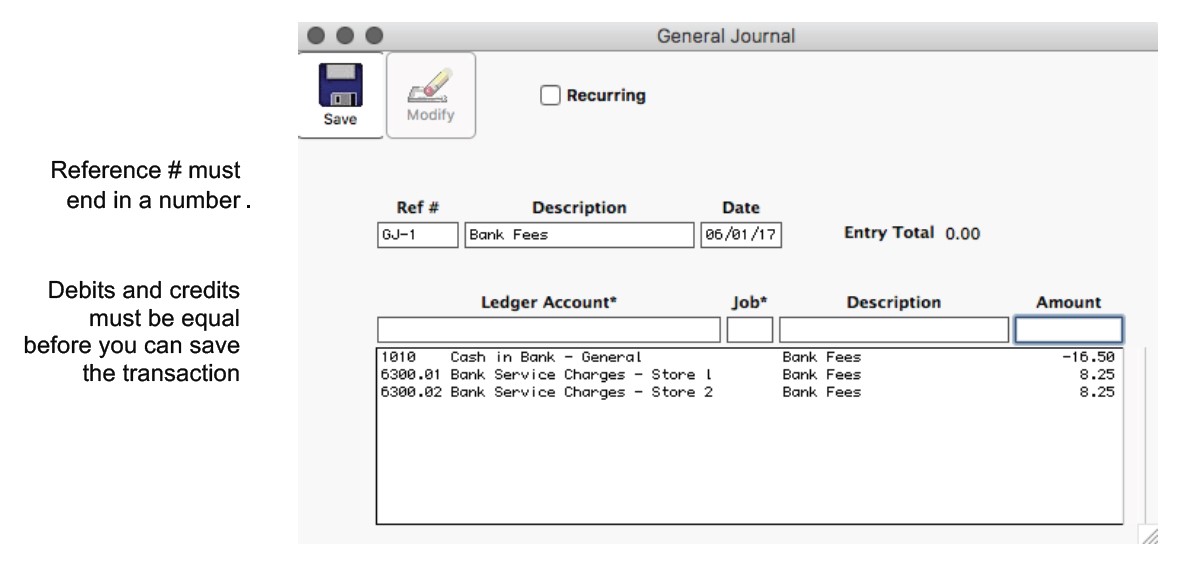

For example, deciding when to implement the pay frequency change can impact a myriad of other issues including the impact on issuing Forms W-2 if done prior to January 1 the effect on salary employees if done mid-year and calculating fringe benefits if they are based on a time frame such as a per payroll period. This manual is for anyone using PSL+ to manage Production Payroll and costs. In addition to compliance issues there are issues that deal with timing, systems, and employee earnings and fringe benefit accruals. The compliance issues that need to be addressed before making the decision to change payroll frequency must consider factors such as: Does the state permit the frequency? And are there any employee notifications required prior to the changes being made? Note: If your deposit frequency changes, perhaps because you've hired a gaggle of. However, it is an arduous task and should be approached with care and tremendous amount of research and preparation. Paying Payroll Taxes the tax agencies, your bank, and your accountant. Mark all taxes to which the pay is subject. If you selected Manual for the basis of step increases, enter or select a step or grade, a step effective date, and an FTE factor.

#Checkmark payroll changing frequencies code

The frequency of paying can be changed, i.e., weekly, monthly, bi-monthly, and more. You can't change this field if the selected pay code is based on another pay code.

Of course, legally changing payroll frequencies is permitted by the states in most cases unless it is done strictly for the purpose of avoiding overtime already worked. Calculate Pay: You can mention the period start and end date as well as the check date here.

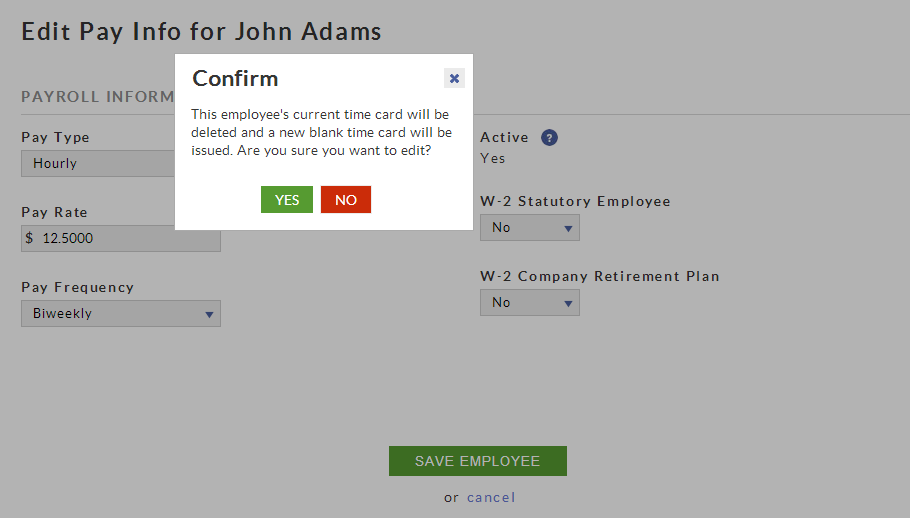

a) The system will generate all periodic payment frequencies based on the. No matter what the reason is, changing the payroll frequency can be daunting and more than slightly harrowing if it is approached without careful planning. b) Allow Manual Payroll Entry:Populate this field using a checkmark if manual. Is your organization planning on having a change in your payroll frequency? Possibly your workplace has grown too big to manage weekly payroll now, or perhaps a certain payroll cycle has become the norm in your industry.

This webinar discusses the legal requirements and the best practices that will be needed when an employer is investigating, contemplating, or initiating a change in payroll frequency.

0 kommentar(er)

0 kommentar(er)